A Cloud-Mining Analysis

Cool-headed review on how to decide

Extrapolating the basics on how to invest in the mining cloud

After a hot-headed review of a cloud mining provider, I decided to cool off and write something really useful

Scientific Modelling, Problem Solving, Optimization, Bitcoin, Cloud-Mining

September 21st, 2014

What should you think before buying Cloud Mining? You might wonder if it is profitable at all. There are cloud mining haters, and there are cloud mining enthusiasts; you might be wondering whom to trust, the answer is: none of them!

Trust Math & Science!

Capital investing is simple, you put an amount of money on something, wait, and get returns on your investments. The big problem with the bitcoin cloud mining world is that the returns are variable, and not guaranteed at all. I'll try to shed some light on the first problem.

How much will the difficulty rise?

If you've done some research, you have already read that bitcoin mining depends on difficulty; and that this difficulty rises exponentially.

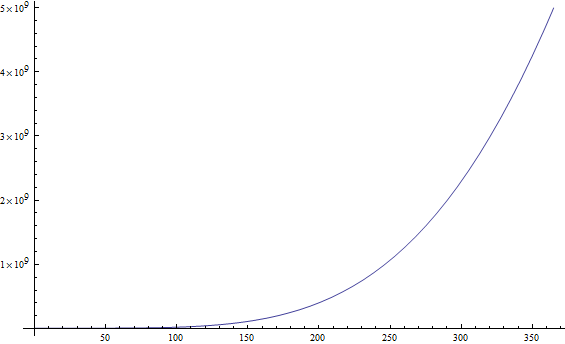

What you are seeing above is a model of how much has the difficulty of mining bitcoin has risen since March 1st of 2013, the X axis represents the number of days since that day. As you can see the graphic represents the span of a full 365-day year. The polynomial describing this function is this:

y = 8154638 + 0.00189782218745504*x^5 + 2.30690254039052*(10^-12)*x^8 - 659.311924843281*x - 3.39747197204999 (10^-6)*x^6

The model above is extremely inaccurate until day 102, like 32% inaccurate on average; to the model's advantage is the fact that after that day its accuracy rises, and its average absolute deviation is 4%. Given the nature of this analysis, I can only vouch for this model's accuracy for the period I have data. Luck will say if it can predict future difficulty rises reasonably well.

Predicting returns on Cloud Mining providers

I've only tested PBMining, right now 161 days have passed since I bought my mining contract. During that time I collected lots of data to write this article, from that data I extracted how much did I earn per GHS bought per day, and then correlated those figures with the earnings that were being sent to me week after week.

Since the difficulty is exponential, the gains from mining are decreasing constantly; and this will continue until a point is reached in which the gains are very close to zero. In math-speak this concept is called asymptote, and it can be viewed as a line that describes the value of a function as it tends to infinity; mind you, the function will never touch the asymptote.

The good thing about these polynomial mathematical models, is that I can calculate their asymptotes. What would it represent? Well, it would say how much coins would you earn from mining an INFINITE amount of time, therefore representing the theoretically possible maximum for the mining situation represented.

I've got a new model since the last article, and luckily its average absolute deviation is only 0.00000739.

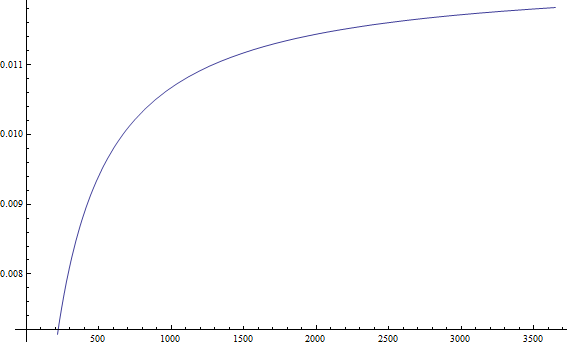

y = (x - 1.61913159457706)/(12340.5916664742 + 81.1765090417067*x)

This function plot represents what you can expect earning, per GHS per day from a PBMining contract in ten years. It's positive horizontal asymptote is 0.0123188347442512. Which means that you can't earn more than 0.012 BTC from this mining contract, and if you've paid more than that you're getting scammed out of your money.

I don't want to wait an infinite amount of time!

You don't have to, the first year you'll earn 70.28% of the theoretical maximum, the second 82.58%, up until 92.22% the fifth year. Like I've said, the returns diminish with time.

I STILL want to do cloud mining, what would be the most reasonable way?

First, you would need to derive a function like I did, from other person's VERIFIABLE data; a jpeg can be easily tampered, you would need to settle for nothing less than tx-ids. After that, you would have to find the asymptote; check if the provider's legit, then invest if the cost is lower than the asymptote. All the while you should aim for a profit margin that's comfortable with you, as the cost may be lower but not by an acceptable margin.

And that's it. I'll happily agree to derive this function for each cloud mining provider available—it would stop the never-ending questions of inexperienced bitcoin miners—I've got PBMining data, whose data have you got?